Can Landlord Deduct Cleaning Fees

Understanding Landlord Rights: Can Landlord Deduct Cleaning Fees?

When a tenant moves out of a rental property, there are often disputes about the condition of the property and the amount of the security deposit that should be returned. One common issue that arises is whether a landlord can deduct cleaning fees from the security deposit. In this article, we will explore the laws and regulations surrounding security deposits and cleaning fees, and provide guidance on how landlords and tenants can navigate these issues.

Security Deposit Laws

Security deposit laws vary from state to state, but most states have laws that govern the use and return of security deposits. Typically, a security deposit is a payment made by a tenant to a landlord to secure the rental of a property. The deposit is usually equal to one or two months’ rent and is intended to cover any damages or losses that the landlord may incur during the tenancy. When a tenant moves out, the landlord is required to return the security deposit, minus any deductions for damages or losses.

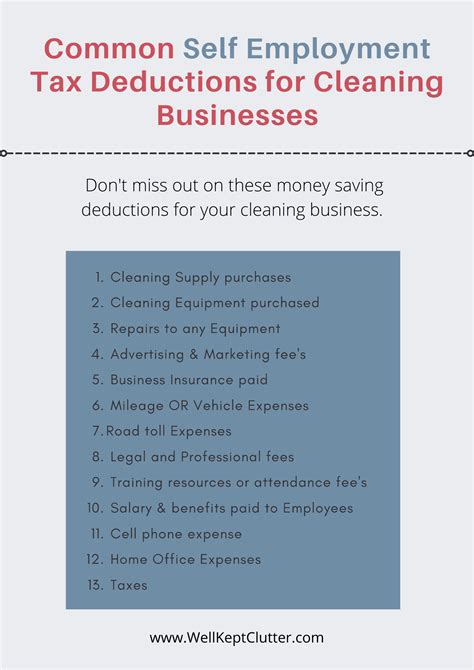

Allowable Deductions

Landlords are generally allowed to deduct from the security deposit for any damages or losses that are the result of the tenant’s actions or negligence. This can include things like: * Holes in the walls * Broken windows * Stained carpets * Missing or damaged fixtures However, landlords are not allowed to deduct for normal wear and tear, which includes things like: * Faded paint * Worn-out carpets * Minor scratches on surfaces

Cleaning Fees

When it comes to cleaning fees, the rules are a bit more complicated. Landlords are allowed to deduct cleaning fees from the security deposit if the tenant leaves the property in a dirty or damaged condition. However, the landlord must be able to prove that the cleaning fees are reasonable and necessary. This can be a challenge, as the concept of “reasonable” can vary depending on the circumstances.

Factors to Consider

When determining whether a landlord can deduct cleaning fees, there are several factors to consider: * The condition of the property when the tenant moved in: If the property was already dirty or damaged when the tenant moved in, the landlord may not be able to deduct cleaning fees. * The length of the tenancy: If the tenant has been living in the property for a long time, it may be more difficult for the landlord to prove that the cleaning fees are reasonable. * The amount of the cleaning fees: If the cleaning fees are excessive or unreasonable, the landlord may not be able to deduct them from the security deposit.

Table of Allowable Deductions

The following table summarizes the types of deductions that landlords are allowed to make from the security deposit:

| Type of Deduction | Allowable |

|---|---|

| Holes in the walls | Yes |

| Broken windows | Yes |

| Stained carpets | Yes |

| Missing or damaged fixtures | Yes |

| Normal wear and tear | No |

| Cleaning fees | Maybe |

💡 Note: The laws and regulations surrounding security deposits and cleaning fees vary from state to state, so it's essential to check your local laws and regulations for specific guidance.

In order to avoid disputes over cleaning fees, it’s a good idea for landlords and tenants to: * Document the condition of the property when the tenant moves in and out * Include a clause in the lease agreement that outlines the responsibilities of both parties regarding cleaning and maintenance * Communicate clearly and regularly throughout the tenancy to avoid misunderstandings

As we can see, the rules surrounding security deposits and cleaning fees can be complex and nuanced. By understanding the laws and regulations, and by taking steps to document and communicate clearly, landlords and tenants can avoid disputes and ensure a smooth transition at the end of the tenancy. The key is to be reasonable and fair in all dealings, and to prioritize clear communication and mutual understanding.

Ultimately, the goal is to find a fair and reasonable solution that works for both parties. By working together and being proactive, landlords and tenants can build a positive and respectful relationship that benefits everyone involved. In the end, it’s all about finding a win-win solution that satisfies both parties and promotes a harmonious and productive living environment.

What is a security deposit?

+A security deposit is a payment made by a tenant to a landlord to secure the rental of a property.

Can a landlord deduct cleaning fees from the security deposit?

+Yes, a landlord can deduct cleaning fees from the security deposit if the tenant leaves the property in a dirty or damaged condition, but the landlord must be able to prove that the cleaning fees are reasonable and necessary.

What is considered normal wear and tear?

+Normal wear and tear includes things like faded paint, worn-out carpets, and minor scratches on surfaces.